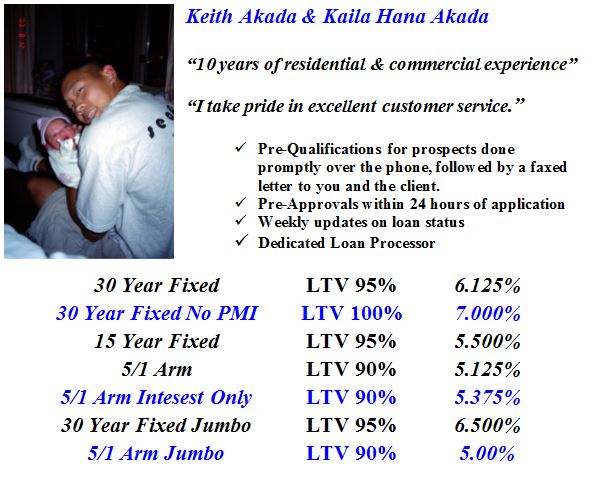

Reviewing my business plan for 2020 I stumbled upon this old paper print ad I would hand deliver to real estate agents and real estate offices in person each week. Yes this was still a time when Fax machines dominated communication. Ha!

My oldest daughter Kaila was just born so this had to have been in August or September of 2003. She’s 16 today! How time flies, how business has changed with technology and HOLY MOLY check out those rates in 2003!

We prepare for 2020 in an election year, surrounded by unknowns of government and global financial unrest. The part that I find the most confidence in the future is the strength of our local markets here in Seattle and the greater eastside. Daily I receive calls from new people who are relocating to our area for job opportunities. Looking to purchase a house and call home. Our jobs market remains very strong with Google, Microsoft, Amazon and Facebook now occupying office space on both sides of Lake Washington. Amazing to say that they not only lease space but are building offices on both sides.

Unlike the great depression where there was a billboard in Seattle that read “Last one to leave turn off the lights” Seattle and Bellevue/Eastside have become a tech hub for some of the brightest and strongest tech work force in the country. Though there is a looming recession in the not far off future, the sense of certainty that I have over the 2007 Housing/Financial bust is our market strength in jobs and industry. We are not just Boeing and Microsoft anymore as a region.

Rates have been projected by both Fannie Mae & Freddie Mac to be the sub 4% range for most of 2020. Read more here. This will keep our local housing market strong as buyers stretch their financing power to keep up with the housing prices being held by a lack of inventory. Land locked, not enough homes and high buyer demand continues to be the outlook for 2020 real estate.

I still remember and to this day keep in touch with a past client who I assisted with their first home purchase. $315,500 was the price with 5% down. The rate……….. 7.25% on a 30 year fixed! They still have the home today as a passive income investment property.

Rates will be volatile as they are now, reacting to both domestic and global news. Inflation is a concern and is on close watch by the Federal Reserve. Should their stance change to inflation concerns rates will react negatively and be pressured higher. We for sure saw this in 2018. The key for real estate is location. The key for mortgage rates is timing. Are you or will you be ready for the right timing to buy, invest or refinance your mortgage in 2020? It is really only a phone all to understand and gain the right education on what options and opportunities could be possible for you. There just nothing I can to do pressure you. It starts with education.

I am very thankful to all of my great partnerships, past and current clients for supporting and trusting in my services since January of 2000, when I began my career as a Loan Officer after nine years in banking.

January 2, 2020 I celebrate 20 years as Loan Officer here in Seattle. I love what I am able to do as a professional to provide and support my family, I love that I am able to educate and support people in home ownership & investing, I love real estate and I love where I am able to Live and Work!

Wishing you a very Happy and Prosperous New Year in 2020!

Cheers, Keith Akada