Seattle Real Estate Mortgage Rates Today 7/28/11 + “Tip of the Day”: Alert to current and future homeowners. The temporary loan limit increase is set to expire on September 30, 2011.

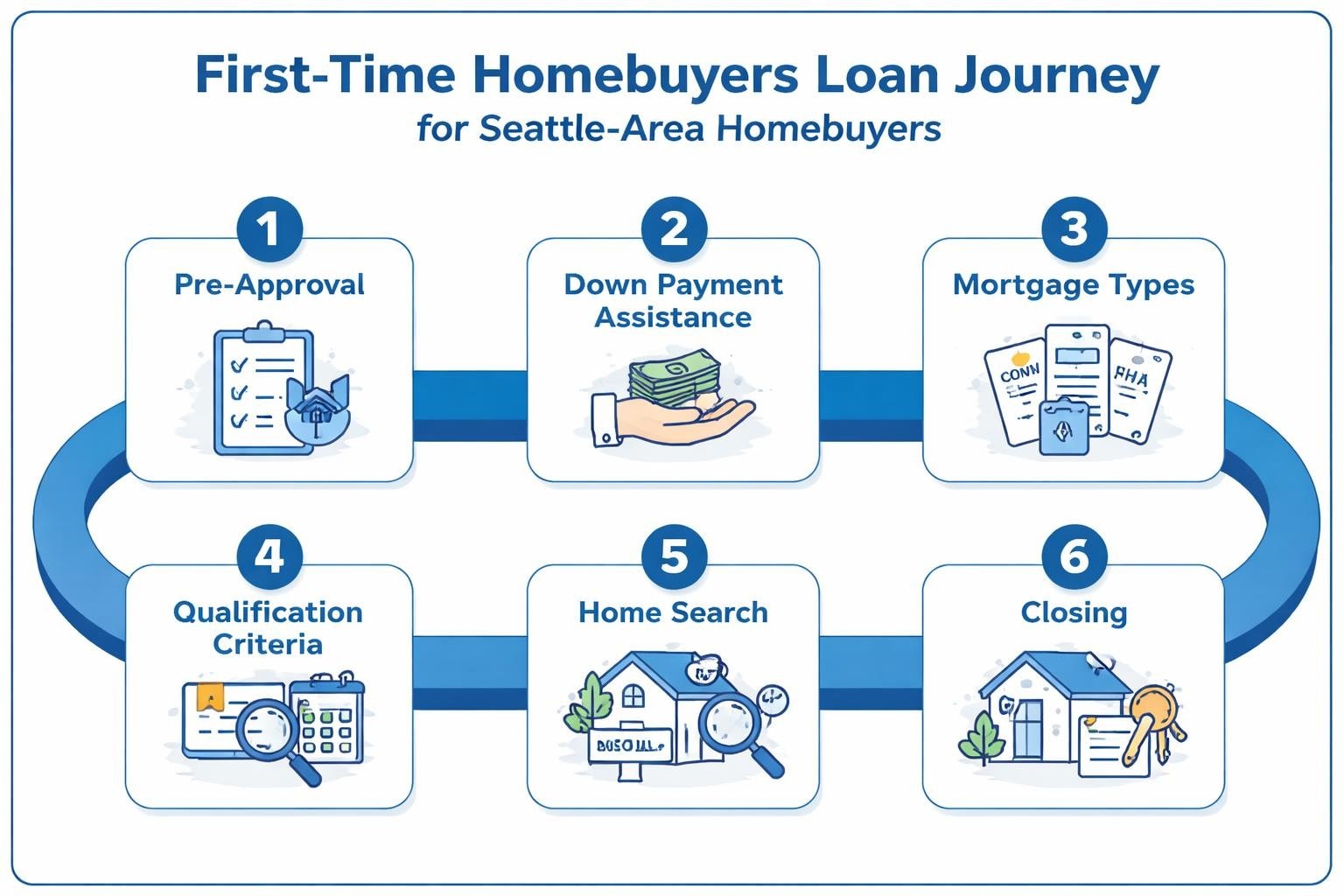

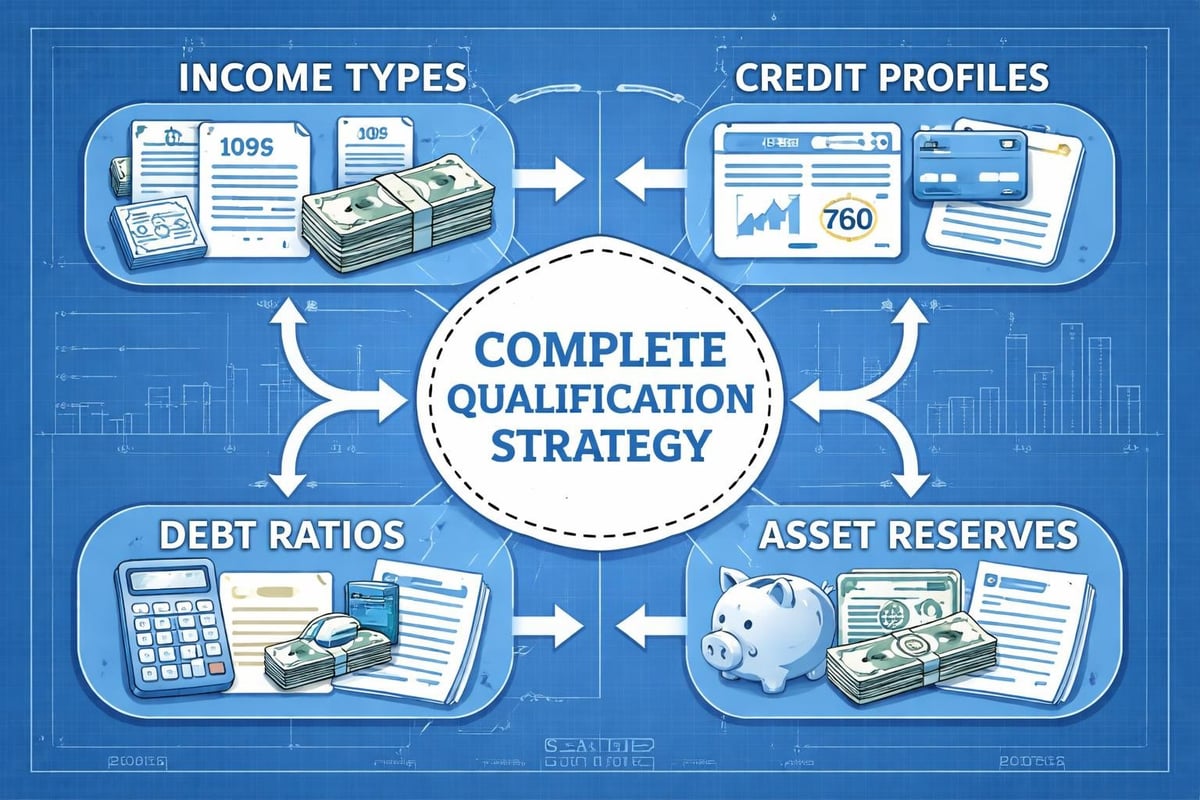

How does this impact me? In today’s market you are able to purchase a home with as little as 5% down with a conventional loan up to a maximum of $567,500 OR with a FHA loan with 3.5% down in King County. HOWEVER if the Temporary Loan Limit does expire ANY loan amount above $417,000 would require a buyer to put 20% down. NO options of Private Mortgage Insurance are available at this time. This would cripple many buyers ability to buy up, especially because we see so many of our buy up clients are families who are moving for education, school districts and have less than 20% down.

What kind of impact would this have? It would not in our eyes have a positive impact for sure. It would be yet another blow to the housing market. The cycle of the housing market has to reopen more aggressively to the JUMBO market. Why? For the last three years so much emphasis has been placed on first time home buyers, but what many do not realize is the cycle, people / families buy up after time, because of a change in lifestyle, i.e. marriage, children or a new job. In these situations the “BUY UP” needs opportunity/financing available to make the move. If financing is not available then they are stuck. Especially if the down payment requirement is 20% which many families or couples do not have. OR if they do have the down payment, they may be cautious to keep part of the down payment in cash until further recovery occurs in the economy which is financially savvy in today’s market. The jumbo market has been frozen since 2007 of the Mortgage Melt Down and has just this year begun to thaw out because of the ability to offer lower rates comparable to the conventional loan. Then to take it away once again would have negative impacts. There is no doubt that the housing market is based off of the results of the West and East coast markets. In each of these two regions the temporary loan limit increase has helped significantly to the housing recovery.

September 30, 2011 is NOT far away especially since we see most of our buyers entering into 30 contracts. This means that if a contract is not signed in the next two weeks the buyer could be taken off of the market due to down payment requirements. Again not a positive impact on the housing market.

As for Mortgage Rates, well watching today’s clip will show the last 30 days has been a see – saw which could make one sea sick. It really all hinges on the “Debt Ceiling” crisis of the Government and their ability to compromise and put political bias aside. It is clear that they just do not understand business. When a business is in the red they have to quit SPENDING. Hello the credit card is maxed out! The scary part is the DECLINE that government keeps receiving at the cash register is not going un-noticed. Moody’s the world’s largest bond rating firm has already issued warnings of a downgrade. A downgrade represents a challenge in the country’s ability to repay debt, exactly what we have recently seen happen in Greece. Can you image what would happen in the U.S. if this happened. SCARY. It is clear that government will take this to the very last day so Democrats and Republicans can have their spotlight on the news pointing the finger at who is right and who is wrong. What a shame.

Off of my pedistal, REFOCUS! Mortgage Rates have also a CAUTION moving into the last half of the year. It is almost unanimous now that banks, economists and financial analyst are all predicting for mortgage rates to move higher before the close of 2011. TAKE caution in this warning. A HIGHER Debt Ceiling will bring back many talks of INFLATION. INFLATION is not good for bonds and will pressure mortgage rates also higher. This is all looking into the crystal ball but we can only translate what is happening today and what is being predicted. What is clear that INFLATION is bad and we are at some time going to hit that wall in the not so distant future.

Make sure to check out today’s segment below: Have a great day Washington, THE SUN IS OUT!!!!!

Timing is everything just as location of the home is critical. Timing in securing an interest rate, BEST rate, is working with a mortgage professional who has their pulse on the market and when best to advise and educate their clients when timing is right. Along with this key knowledge is to be on top of all of the lending and underwriting changes which seem to almost happen daily. We at the Mortgage Reel are Licensed Washington Loan Originators, serving clients with transparency, knowledge and most importantly keeping your goals in mind. How can we assist you today?

Join the Conversation on Facebook, just click on the banner on the homepage and it will take you to our Facebook page, “How to Beat the Banks on your Home Loan” Like us when you visit and post any comments or suggestions. We want your feedback.

Leave a Reply